It is the tax season in France, and that, unfortunately, also means that it is the season of tax scams. But how can you tell the fact the false? Here we show you how to avoid ‘Les Arnaques Aux Impóts’.

If you make its online income tax declaration, the portal has been open since April 10. It is possible that you have received a reminder by email from the charming Taxman of France. Or do you have?

Read too The French Fiscal Guide for the Bumper for 2025

Electronic emails

Any mail of the cleaning Taxman will come from the following address (after the sign @): @dgfip.finances.gouv.fr

Ignore emails that do not include this address exactly as mentioned above.

Other tracks may include spelling and grammar errors in the text, which could be more difficult to detect for non -native French speakers.

Be careful, an email that seems to be too urgent, if the title says ‘alert’ or ‘brake delivery’ in the matter line, processes with caution.

Read too The French website that helps you avoid financial scammers

In addition, never respond to an email requesting your bank data, credit card number or a copy of your identity documents.

French tax authorities are not allowed to ask users to provide bank data or personal information by email, either to pay taxes or claim a tax or reimbursement, or reveal their personal data. If you are asked to do so, do not respond to this message.

Read too How to know if a message from French authorities is a genuine fraud or a scam

Advertisement

Websites

If you intend to complete your French Income Tax Declaration online, know that there are only two official links.

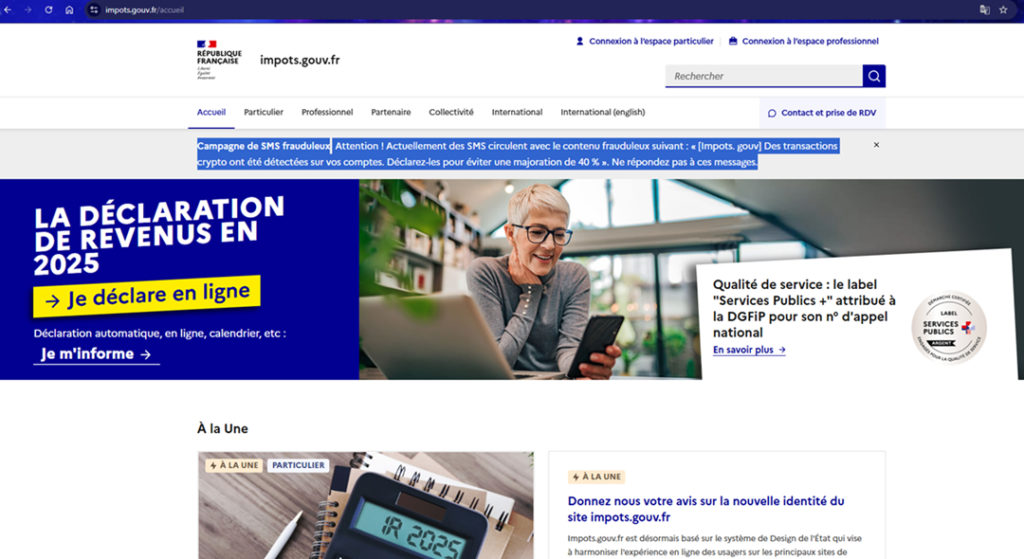

The first is the home office’s home page, in this address: www.impots.gouv.fr/accueil

It looks like this.

The cover of the Income Tax website in France. Image: Impots.gouv.fr

The cover of the Income Tax website in France. Image: Impots.gouv.frYou will notice, in the Screenengrab, a warning against fraudulent SMS messages read: Warning! SMS messages are currently circulating with the following fraudulent content: “[Impots. gouv] Cryptographic transactions were detected in their accounts. Declare them to avoid a surcharge of 40%. “Do not respond to these messages

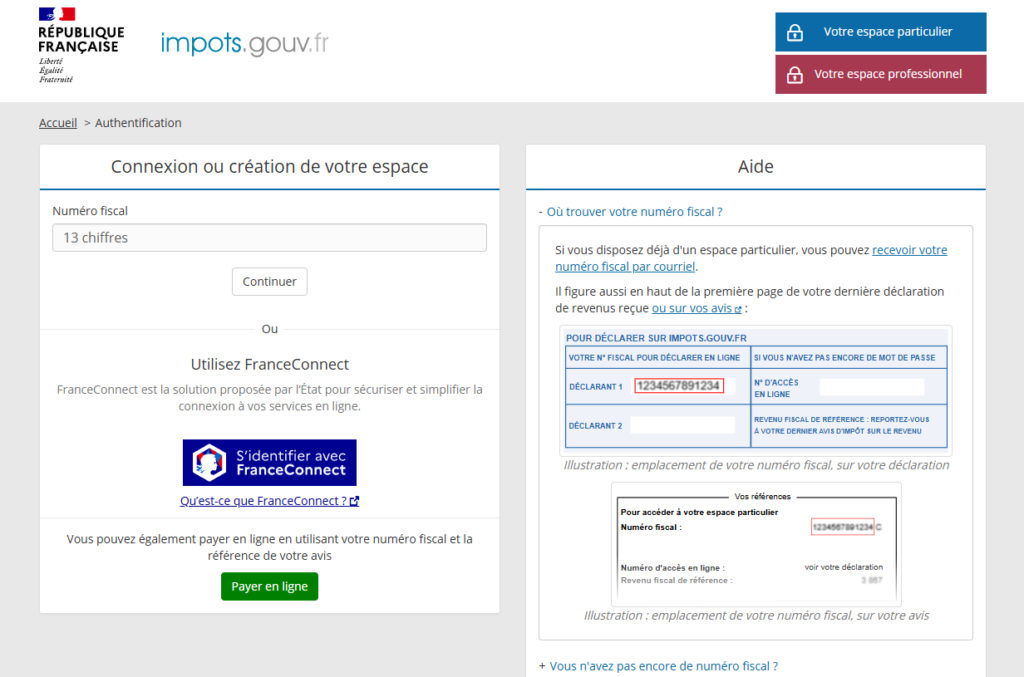

The second official URL is this: https://cfspart-idp.impots.gouv.fr

Advertisement

The destination page looks like this, and allows you to connect to your personal space, using a 13 -digit reference number. It would also reach this page from the initial website of Impots.gouv.fr by clicking ‘Connexion à l’Es Espace Private’.

The page on which users access their personal account on the France Income Tax website. Image: Impots.gouv.fr

The page on which users access their personal account on the France Income Tax website. Image: Impots.gouv.frOnce you have accessed your personal tax account, the URL is shown https://cfspart.impots.gouv.fr/enp/ In addition, some letters that change according to the tab you click on. Here you can make your statement without fear of scams.

The basic rule to avoid scams is simple. Web address for any tax declaration should always include this: Impots.gouv.fr

Unfortunately, scammers know it. Therefore, they often create false websites that not only look much like real: the web address is also very similar.

Read too How to avoid being a victim of tax scams in France

See the web address carefully, and several times, if you need it. The scammers have used Impots-gouv.fr (a script instead of a complete point); or impot-gouv.fr (a script and impot is singular); or Impotsgouv.fr (without full point between Impots and Gouv).

You can easily lose everything, if you are even a bit distracted. The best advice, always, is to verify the address very carefully.

Advertisement

Also be careful for the addresses that end “.com”, “.net” or simply “.eu”: these are also false.

SMS

On April 15, the cover of the France Tax website presented a clear warning about fraudulent SMS messages. Read Warning! SMS messages are currently circulating with the following fraudulent content: “[Impots. gouv] Cryptographic transactions were detected in their accounts. Declare them to avoid a surcharge of 40%. “Do not respond to these messages

The objective of any fraudulent SMS message is to panic to respond and click the text message link. It is a phishing message.

Read too How to avoid typical French tax scams and other fraud

If you click on the link, you will reach a site that looks very similar to the Real Tax website. Confirm checking the address bar at the top.

Leave the website, report the SMS message. As long as you have not entered personal information, criminals have failed.

Read too What to do if you have been the victim of a scam in France

]