If he predicted that technology batteries would be reduced in 2024, a good bet was likely.

After all, the line of trend had been directed in that direction. The average number of applications in companies batteries was reduced in both 2022 and 2023, although only for a modest amount, less than 10% on average. But the economic times were pressed last year, and the CFOs were in the war to reduce SAAS waste. And, of course, there is the ongoing narrative of 10 years that the entire Saas industry, special Marsch, has been mature for consolidation.

Therefore, betting on Saas pilas in red, would have seemed a safe bet.

However, if you made that bet, I’m sorry you lost.

The last report of the SAAS management index has just published Zylo, a leading SAAS management platform that manages more than 40 million SAAS licenses and $ 40 billion in SAAS expenses. It is based on difficult and empirical data or costs of tracked saas, not soft surveys where people guess, always far away, how much saas Think they have.

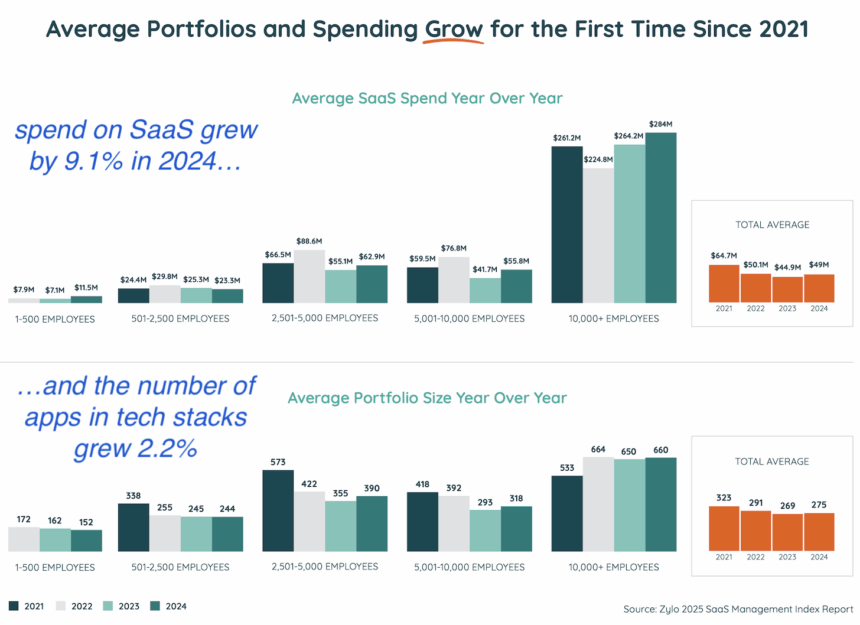

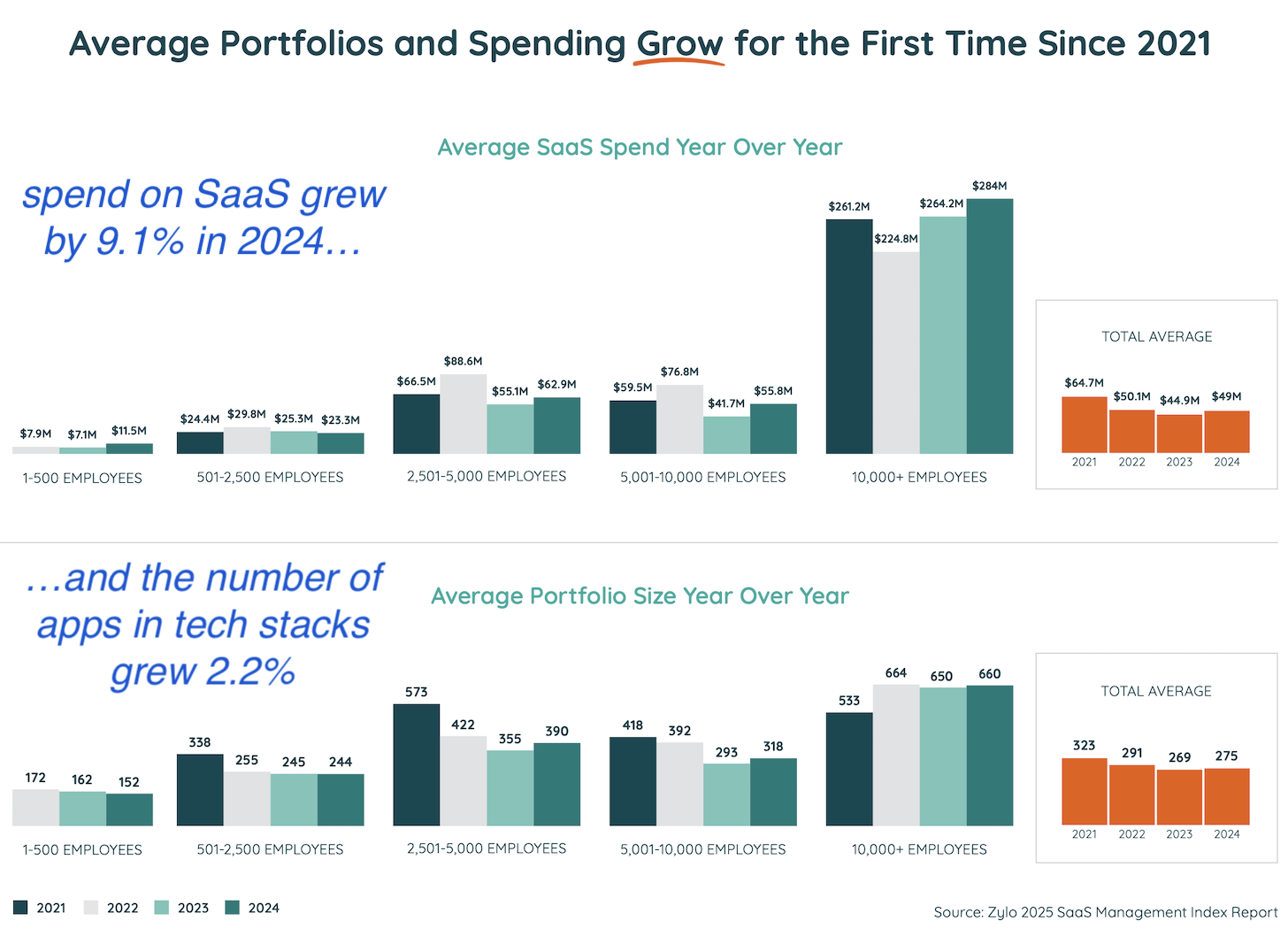

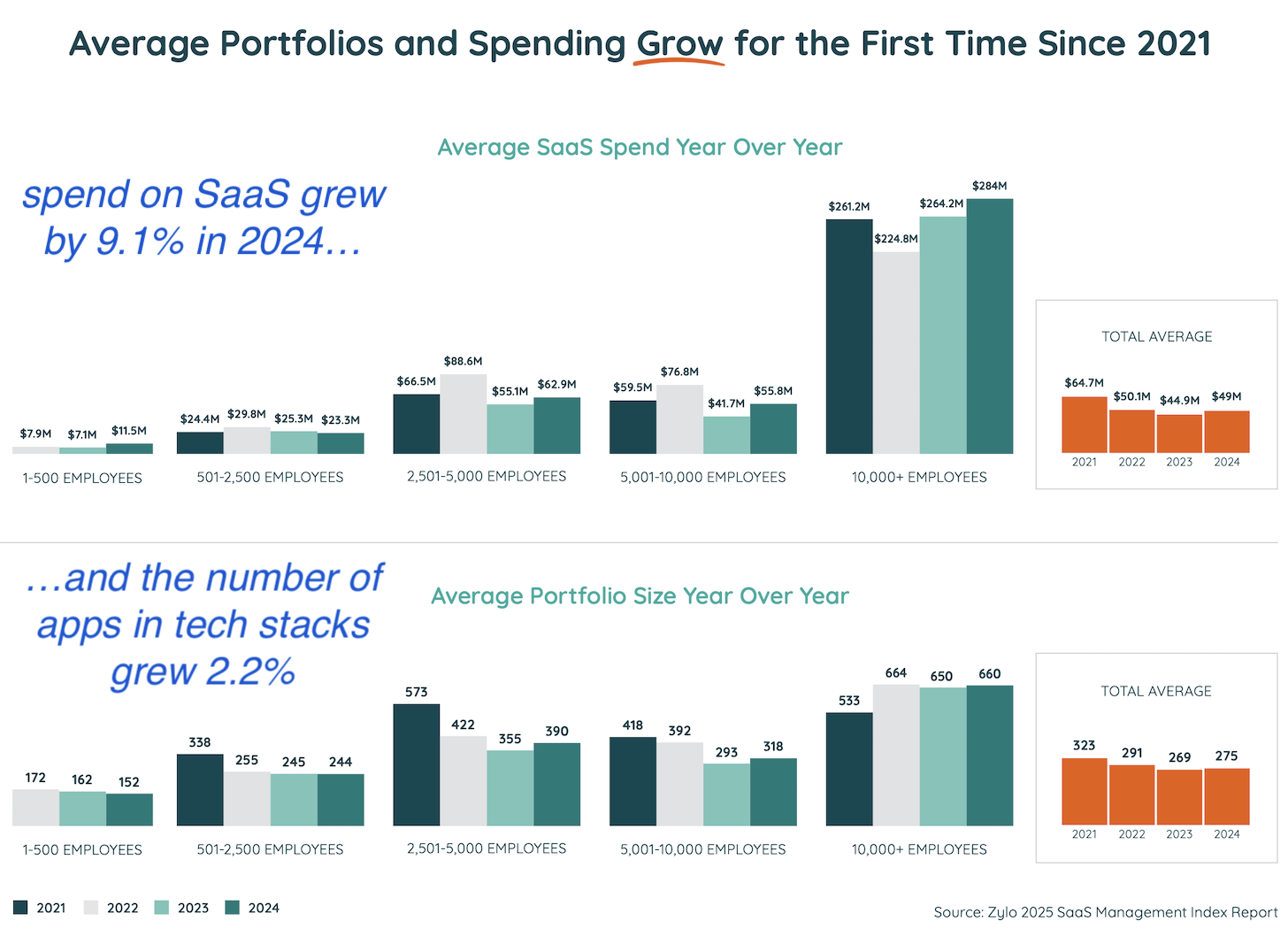

According to the data, the average number of SAAS applications in batteries grew by 2.2% In 2024.

Now, I know, 2.2% is not exactly a fugitive growth. And there were mitigating factors – Cough, ai, cough – That countered the underlying dynamics or Saas consolidation. But wasn’t that the story now to, why, 14 years? Technology continues to consolidate … except for all the new technology that continues to flow.

Spending in Saas in 2024 grew even more, for 9.1%. This was largely due to many SAAS vendors that increase their prices, a privilege, which purchase buyers should receive IONY or granted to more consolidated suppliers. Be careful what you want. But there was clearly a sufficient reason for companies, even under the surveillance of CFO, they did not significantly reduce the size or expenditure of the battery.

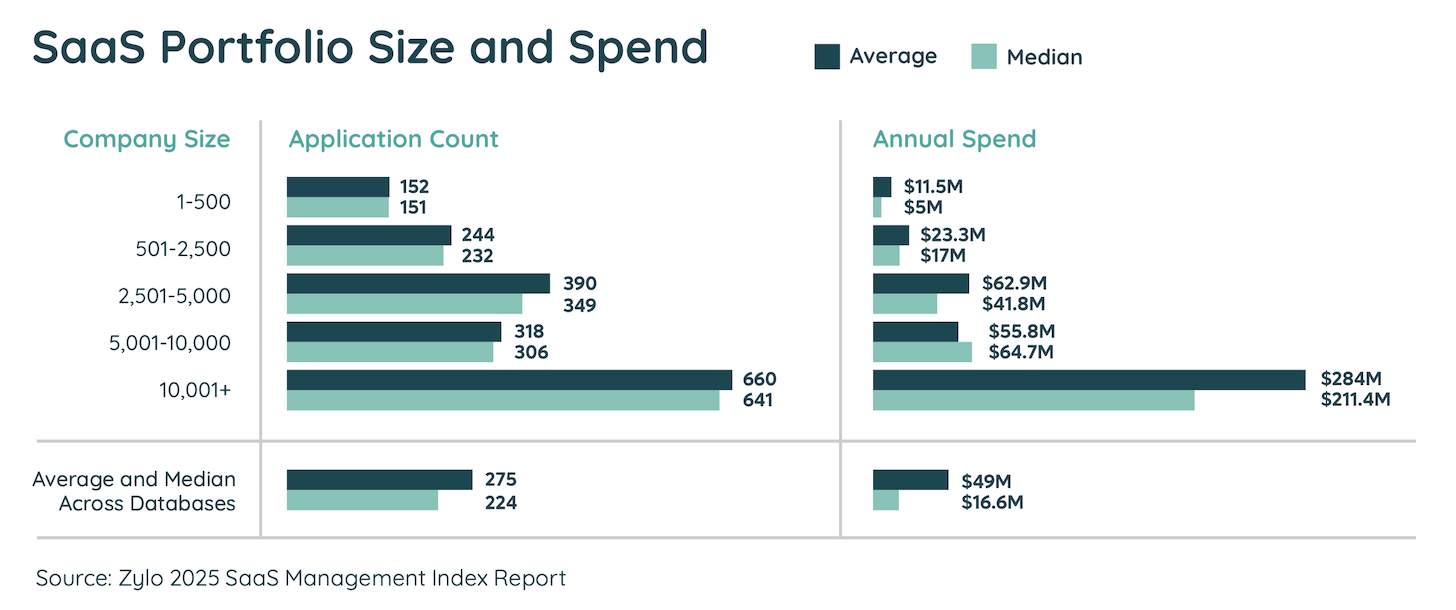

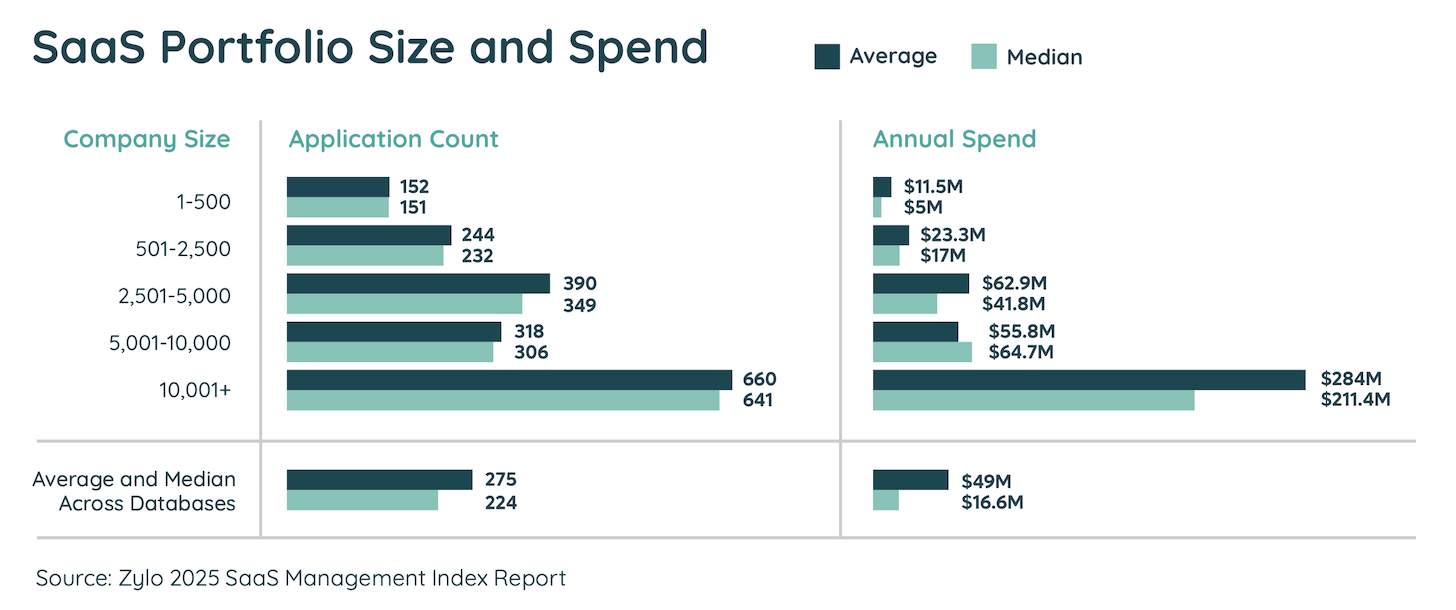

One thing that Zylo did this year, which I really appreciate, is to distinguish between the Mean and median Averages of the size and expense of the battery:

As expected, the medians are lower than the media. We know that some companies only have really extensive technological batteries, which achieve the average. The median better reflects the “average” real company. That said, it is interesting to note that the medians do not That Much lower than the media. Therefore, it is a fairly solid conclusion that considerable Saas batteries are not atypical values, but reflect reality for most organizations.

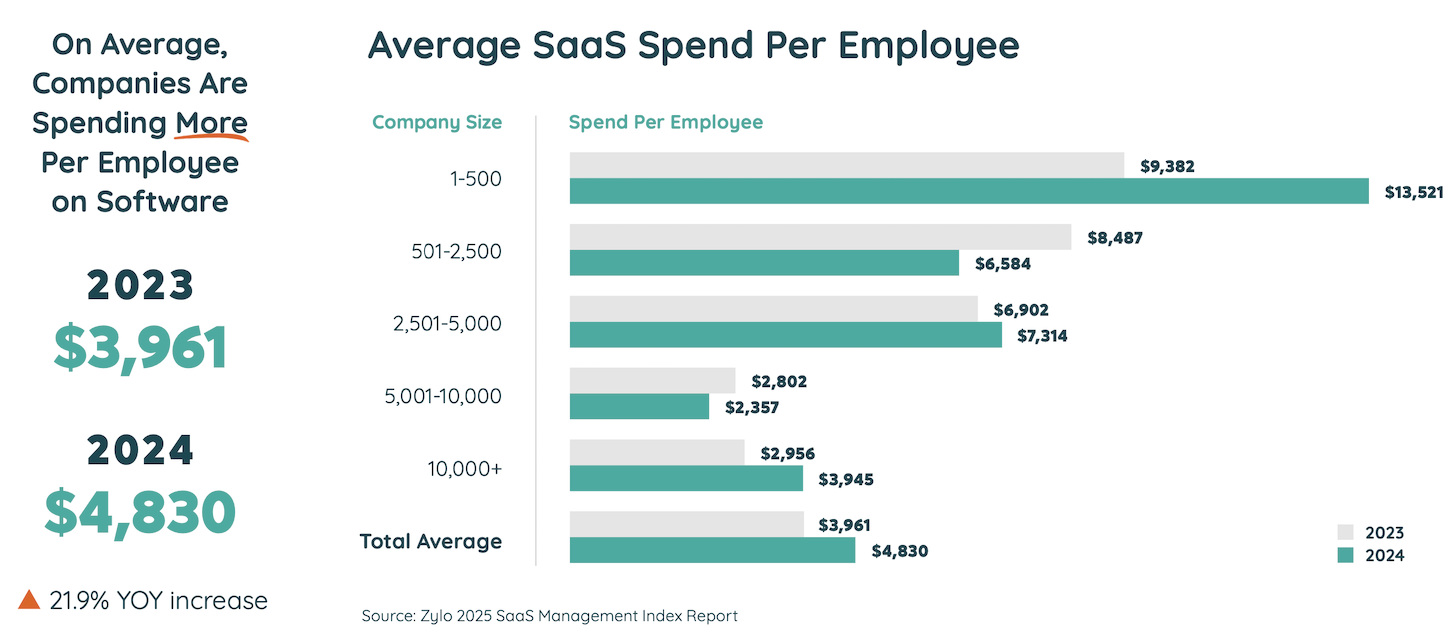

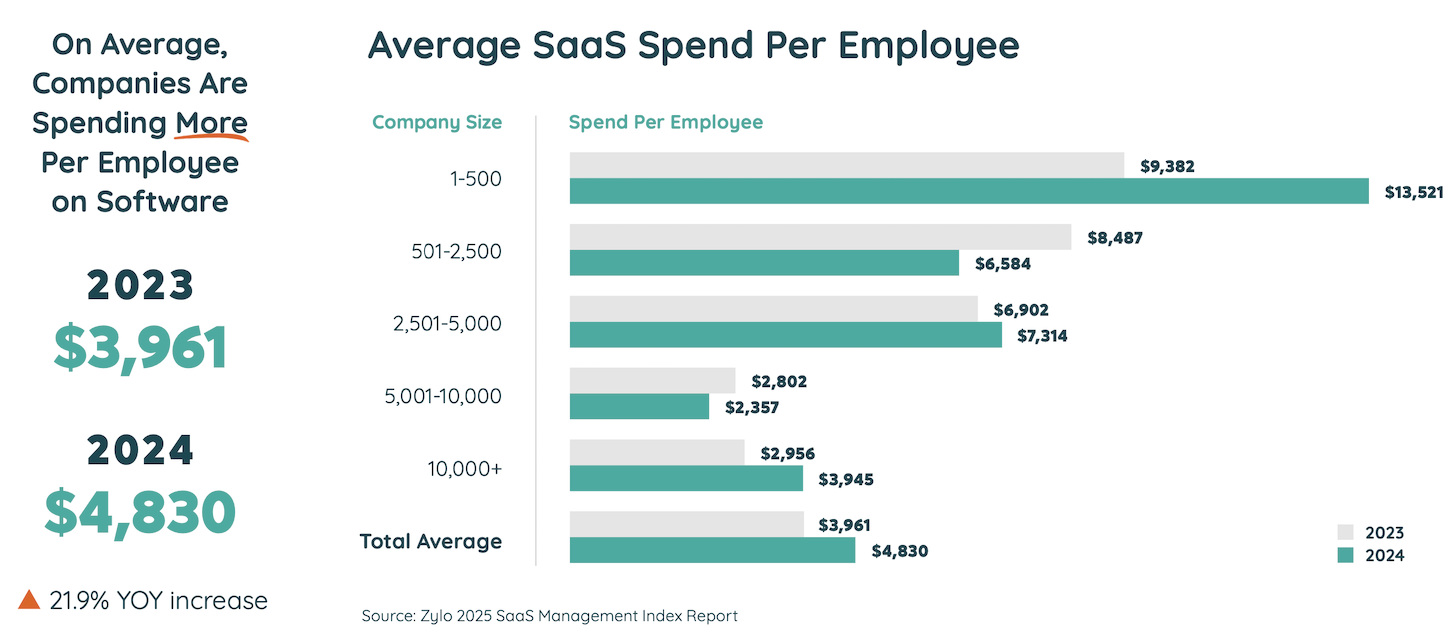

Another interesting statistic: The average SAAS expenditure per employee grew 21.9%.

Making the calculations, if the employee spending grew more than 2 times as the general spending of SAAS, then the denominator, the number of employees, will be reduced without a corresponding fall in software investments. This is more pronounced in the SMB segment of companies with 1-500 employees, which reported a huge 44.1% Increased SAAS expenditure per employee.

While it is an attribute too early to this mainly to AI, it is the general narrative of our time: The software relationship for humans in commercial operations is increasing. And it will increase more, more and more. It is shown before in SMEs because this segment includes many new digital native companies, and SMEs are usually more agile and less reluctant to risk than companies. They are undertaking software for their financial advantage. And in this new wave of AI interruption, that could be a great advantage.

Sam Altman’s vision of a single -person company and $ 1 billion would be the extreme incarnation.

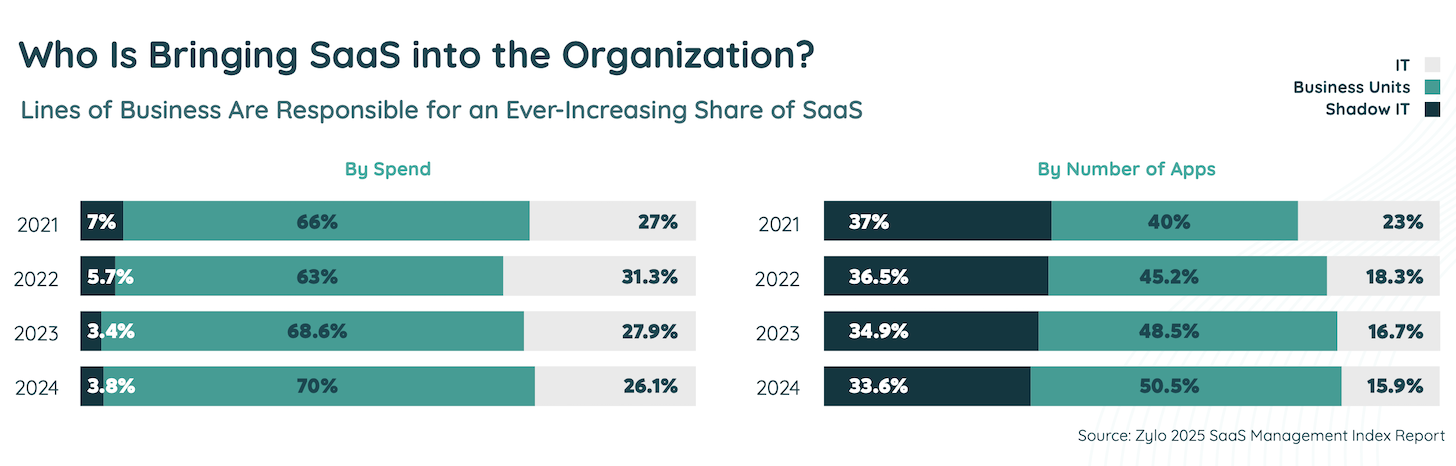

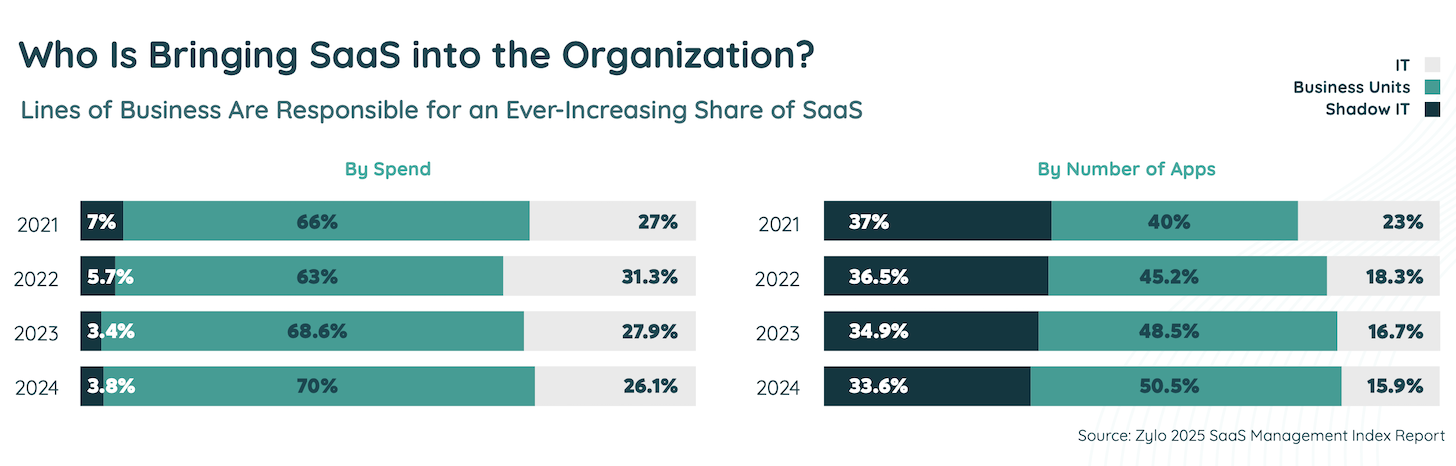

But returning to the current land, let’s see another important solidified trend in the Zylo report. Who possesses all these applications of population of the battery: IT, Business Units or “Shadow” (in this context, employees who buy software in their credit cards and spent it)?

The answer is quite definitive: business/departments units. Most applications have (50.5%) and pay for the fixed spending majority (70%). This trend has been growing constantly for the past three years.

That is likely not a surprise for those of you in the marketing who read this. Much of the software we are using today is specific to our work. See the landscape of Marsch. It makes we must select, pay, operate and be responsible for it because it is very deeply intertwined in our trades and operations.

It still controls 26.1% or all software expenses, although for a small percentage or applications (15.9%). This makes sense, since it should have software that covers multiple commercial departments. That is typically a narrower number of applications, and mostly larger platforms and infrastructure. While I avoid predictions, I suppose that the proportion of expenses under it will increase in the coming years as more crossed organ technologies gain impulse, especially in the data layer and with general purfosis AI platforms.

As a percentage of applications in the stack, Shadow follows a solid 33.6%. The battery police have been able to shave a more or less point every year during the last 4 years, but it is difficult to give in any significant degree. People like their applications.

However, for all more obsessive financial persons, the shadow remains a rounding error or only 3% or 4% or software spending. The CISO can have a more legitimate meat on safety and privacy risks.

Even then, if you look at the 10 best applications that are more commonly expected as Shadow It, they are: Udemy, Chatgpt, Canva, Kudo Kard, Cliftonstrengiess, LinkedIn, Openi API, Grammarly, Adobe Acrobat and Kahoot. With the exception of Chatgpt and OpenAi API, which should leave No Run out of government; Most of these seem a relatively low risk. Idly, they must be governed. But there are probably bigger fish to fry.

Anyway, I have barely scratched the surface of the wealth of validated ideas for data on technological batteries in the Zylo report. I strongly recommend collecting a copy.

It will be a fascinating year ahead. Any assumption about how technology batteries will be seen for January 2026?