Expanding into international markets is a crucial step for any existing business trying to realize their full potential. In terms of market share, breaking into new markets can greatly increase the available terrain. And for businesses with a product or service of value, new markets can mean new business opportunities.

Like any other business endeavor, expansion comes with risk. There are barriers to entry, culturally based differences in language and consumer buying habits, and the state of your industry might look quite different elsewhere in the world. Everyone, from C-level executives to sales and marketing teams, should understand a future market’s potential and pitfalls.

Before making any decisions about expansion, it’s important to conduct a market analysis, a business potential assessment, and develop a business plan for expansion. These steps will help you reduce risk and find the right entry point into the new market.

In this guide, we’ll walk you through how to assess a market, so you can be more confident about developing a go-to-market strategy for a non-domestic region.

Market Assessment Research: A Look at Top Markets for International Expansion

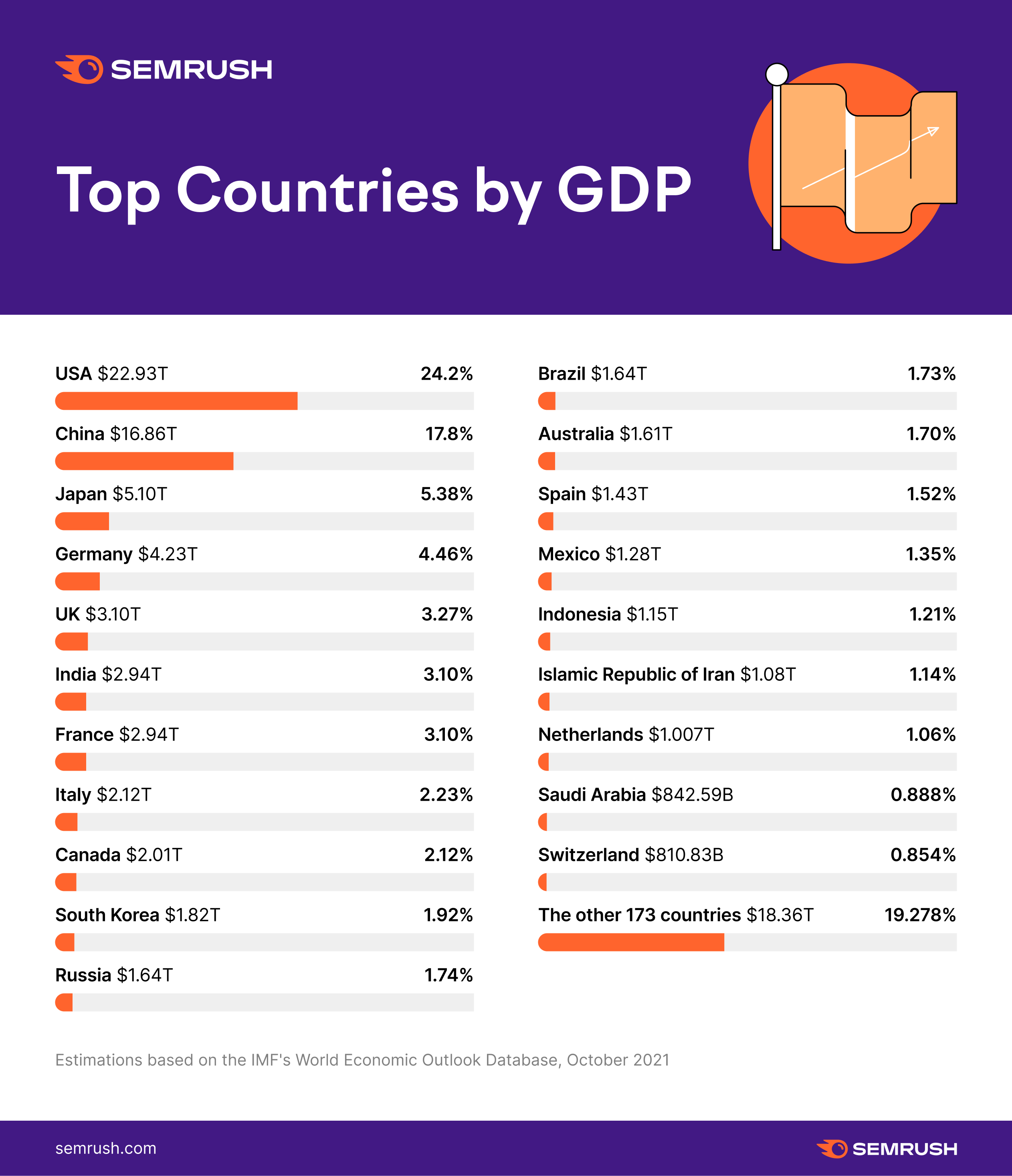

To begin broadly, let’s look at Gross Domestic Product (GDP) across the globe. GDP is the total market value of all products and services produced within a country during a specific period of time. Among other things, GDP can provide a broad snapshot of a specific country’s economic health, which is important information when considering an expansion.

The US currently holds the top spot when it comes to global GDP, accounting for almost one-fourth of the total global economy. If you plan to grow your business within the US, this might be encouraging. But if you were looking for additional options beyond your domestic market, you could begin by looking to other leaders.

Those that follow the US—China, Japan, Germany, India, and the UK—might be full of untapped potential. But at this stage, don’t write off any key player, and remember, these standings will almost certainly change over time.

The next graph projects some significant movements in GDP by 2030. Experts estimate China will eventually move into first position for economic growth. India is predicted to surpass today’s leaders, too, along with several more economies that could also strengthen their positions. The global GDP picture might look quite different in 10 years.

If such growth happens, the opportunities could be huge. And if you place the right bets in these locations, you could find yourself with major gains down the line.

Many large US companies—including Mattel, ExxonMobil, Apple, and GE—are already tapping into growing markets. Close to two-thirds of their total sales come from outside the US. Netflix now has about 56% of its customers outside the US, with 90% of its growth fueled by international markets.

A cursory global market assessment shows that there might be opportunities for certain offerings around the world in years to come. The question is: how do you select a country to begin your expansion efforts?

How to Do Market Assessment with the Goal of Expansion

Conducting a foreign market assessment on a step-by-step basis ensures you leave no stone unturned. You’ll want to study a variety of factors, such as:

- The strengths and weaknesses of the economy

- The size of the market and levels of competition

- The competitive landscape

- Customer behavior and sales funnel data

- Language, cultural barriers, and societal barriers to entry

Before you even start looking into new markets, make sure your product-market fit in your existing market is strong. This is especially true for small businesses with tight budgets. If you don’t see growth in your current region, expanding elsewhere might not be the answer.

Take time to hone your product, understand your customers, and refine your marketing message at home before following these steps to prepare for a completely new market.

Step 1. Study various markets for existing opportunity and growth potential

Before choosing a location for your expansion, explore various markets and compare them against one another. At this first step, your primary goal is to make sure that the new market is suitable for an expansion. Consider:

- Market size

- Level of competition

- Major players and their market share

Gathering data and comparing countries may reveal opportunities you hadn’t considered, affirm your initial suspicion about a prospective market’s strength, or reveal unforeseen risks.

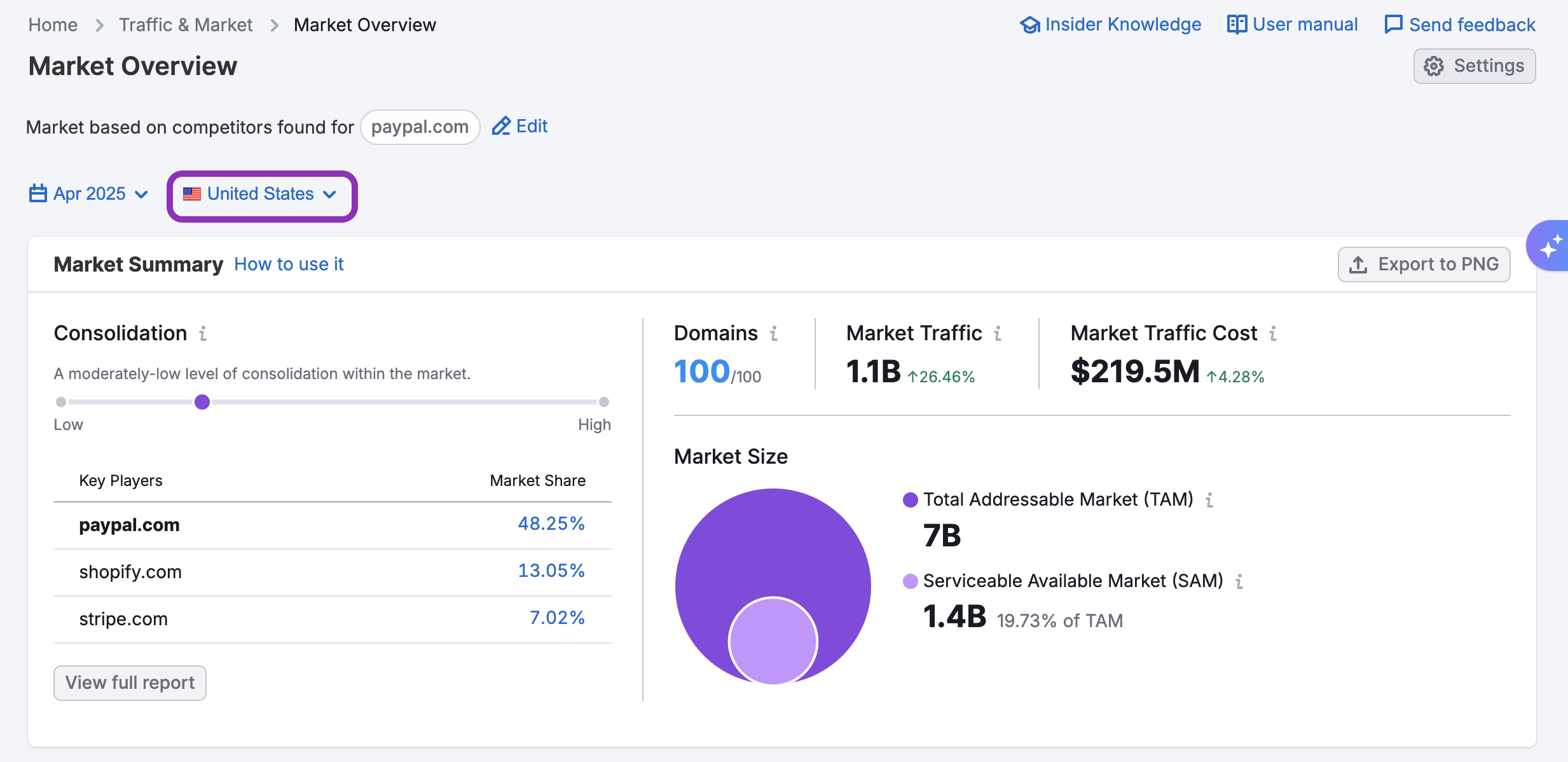

Inside the Semrush Traffic & Market Toolkit, you can uncover a market based summary using the Market Overview dashboard. We entered Paypal.com and the tool produced this summary of the payment processing industry in the U.S. market.

Though the U.S. market is large, the consolidation levels are medium, meaning it’s not going to be super easy to compete. This is due to the fact that a small number of domains—Paypal.com in particular—own almost all of the market for payment processing.

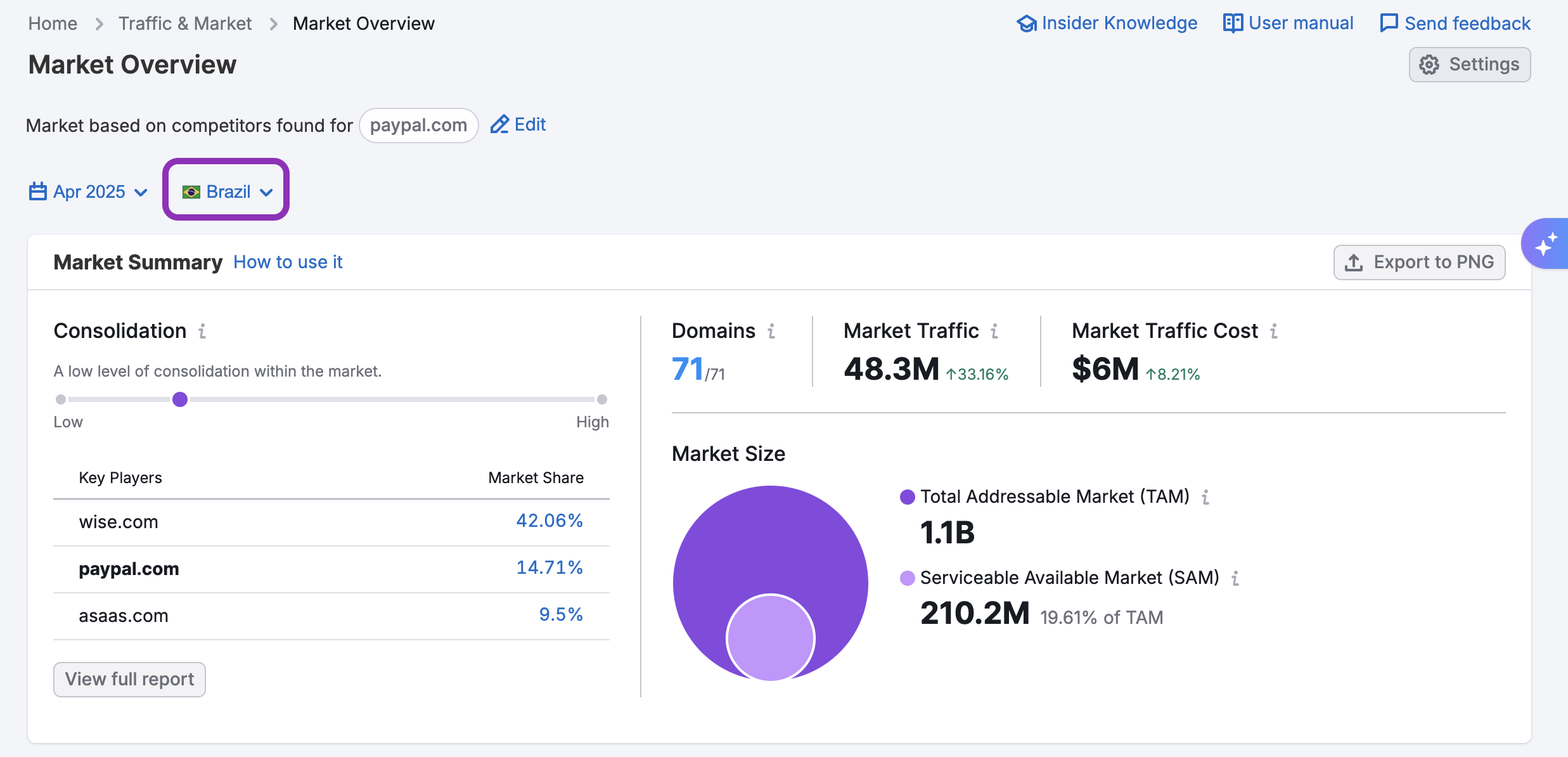

However, when changing the location to Brazil, the market looks a bit different.

Still, a small number of companies own the majority of the market, but market shares among these companies are more spread out. The market size is also significantly smaller than that in the US, indicating a smaller amount of market demand.

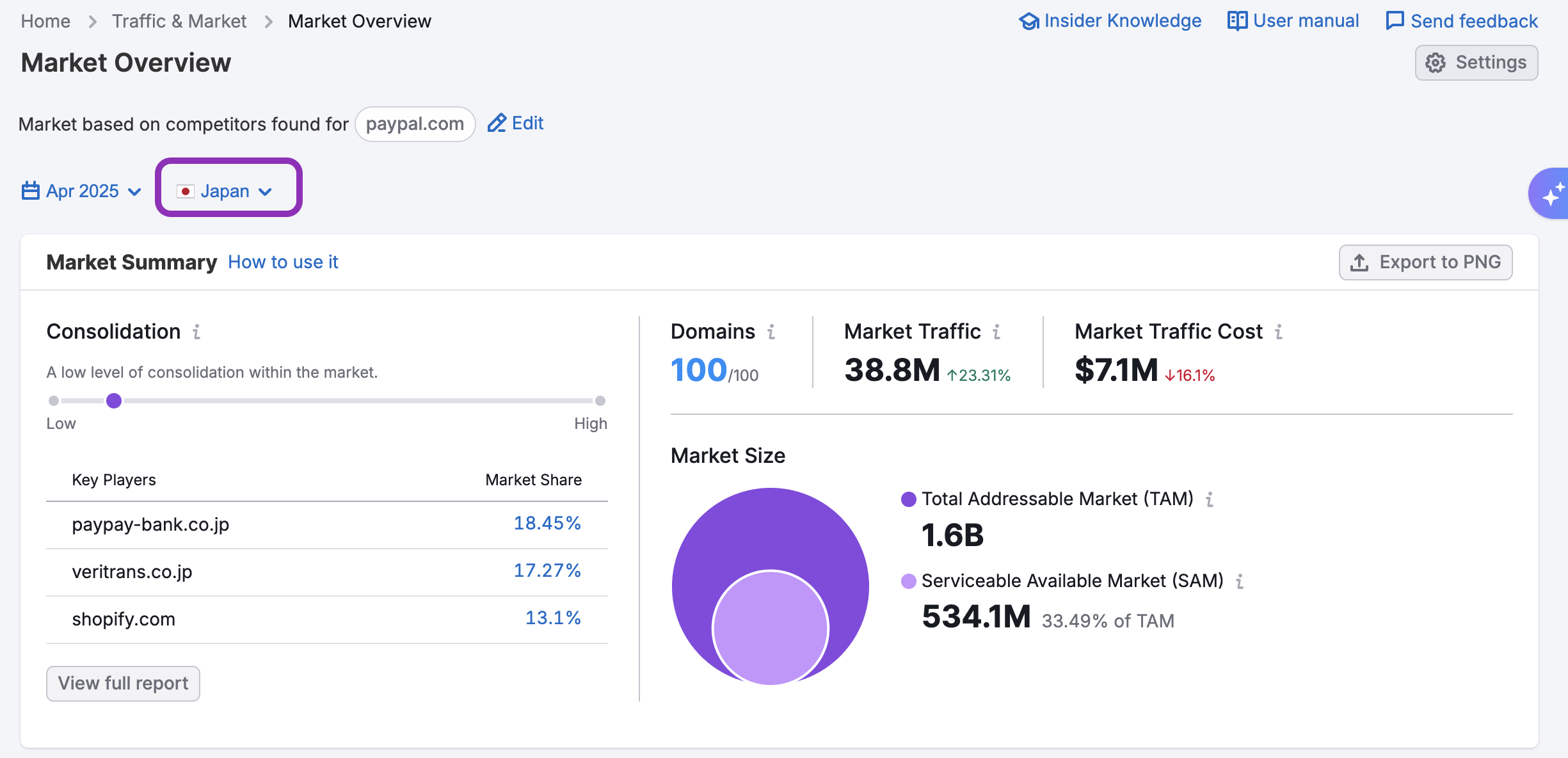

Finally, we looked at Japan, which seems to offer the best potential.

Because the market share is spread out more evenly among a larger number of players, it’s easier to compete in the Japanese market than the Brazilian or US markets. The TAM is slightly smaller, but the SAM is also proportionally smaller, meaning the market has more potential for growth.

Step 2. Get a full view of the competitive landscape in your potential markets

Once you discover your top locations for expansion, get familiar with the competitive landscape. An understanding of the layout of the playing field, the strength of the competition, and the strategies they’re using allows you to enter the market knowing what to expect.

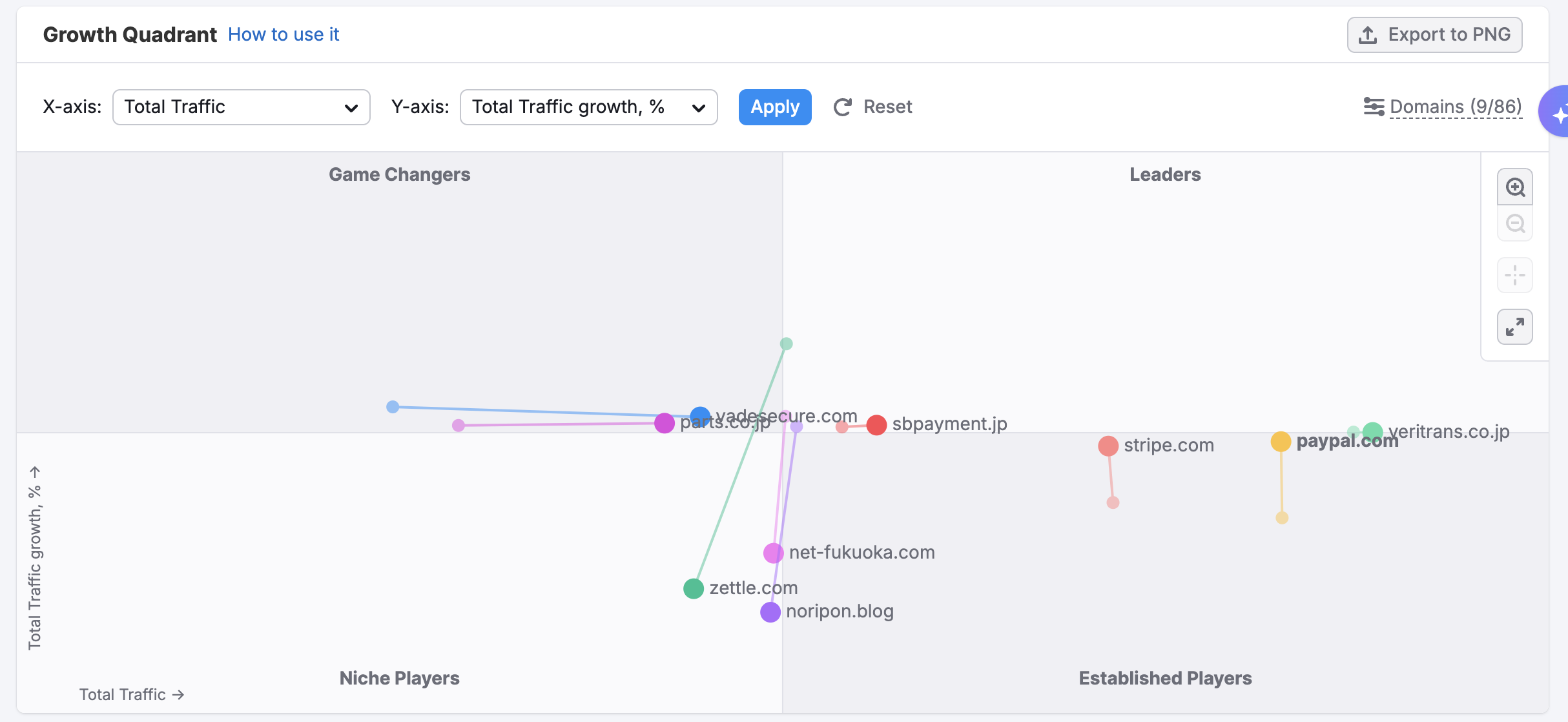

A competitive matrix is a great way to consider the market as a whole. The Growth Quadrant found in the Market Overview dashboard is one example of a matrix that offers a visual layout of the competition based on traffic and traffic growth percentage.

In Japan, paypal.com is an established player, meaning the domain has consistently high traffic, but hasn’t seen a lot of growth. We might also consider the two companies in the “Game Changers” category. They all seem to be on a steady growth trajectory.

Once we’ve identified specific companies of interest, we can then turn to other dashboards, like the Traffic Analytics dashboard, to dive deeper into traffic and growth trends. We’ll explore this in more detail in Step 5.

Step 3. Analyze your potential customers’ behavior and funnel data in selected markets

While intel on competitors is a crucial component of new market research, it’s only a piece of the picture. Along with the competition, you need to understand consumer behavior and buying patterns within the market to expand successfully.

To begin, carefully analyze your in-house data to uncover trends related to the specific markets you’re considering.

- Do you see a surge in leads from a particular market, despite limited investment there?

- Do you see a shorter sales cycle or a higher win rate in some markets?

- Is the average purchase price higher in a given market?

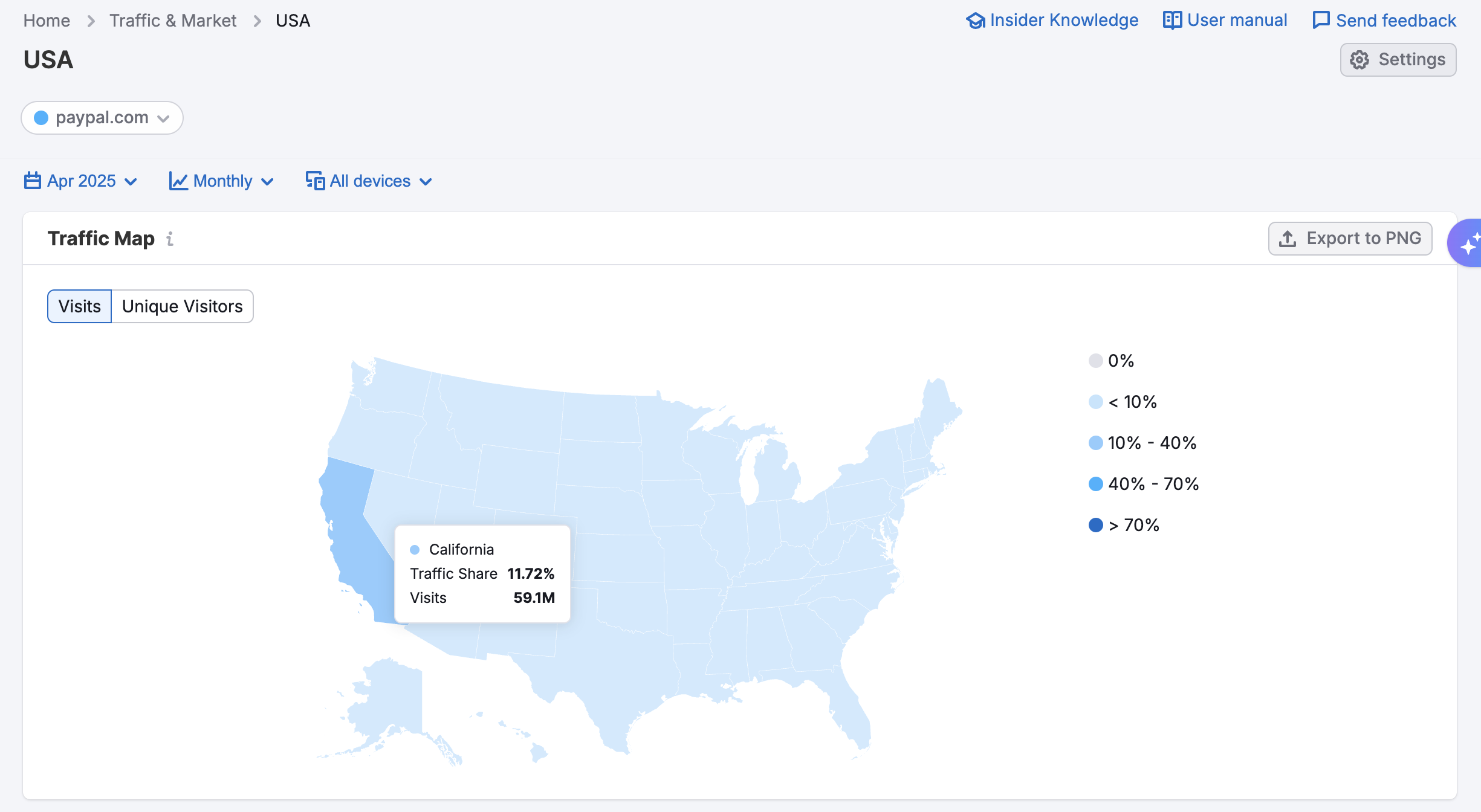

Most internal analytics platforms track traffic distribution by location so you can see where it originates, what happens to that traffic upon arrival, and to what extent it converts. You can also use Semrush’s USA dashboard or Countries dashboard to view state-based or country-based traffic trends in your market.

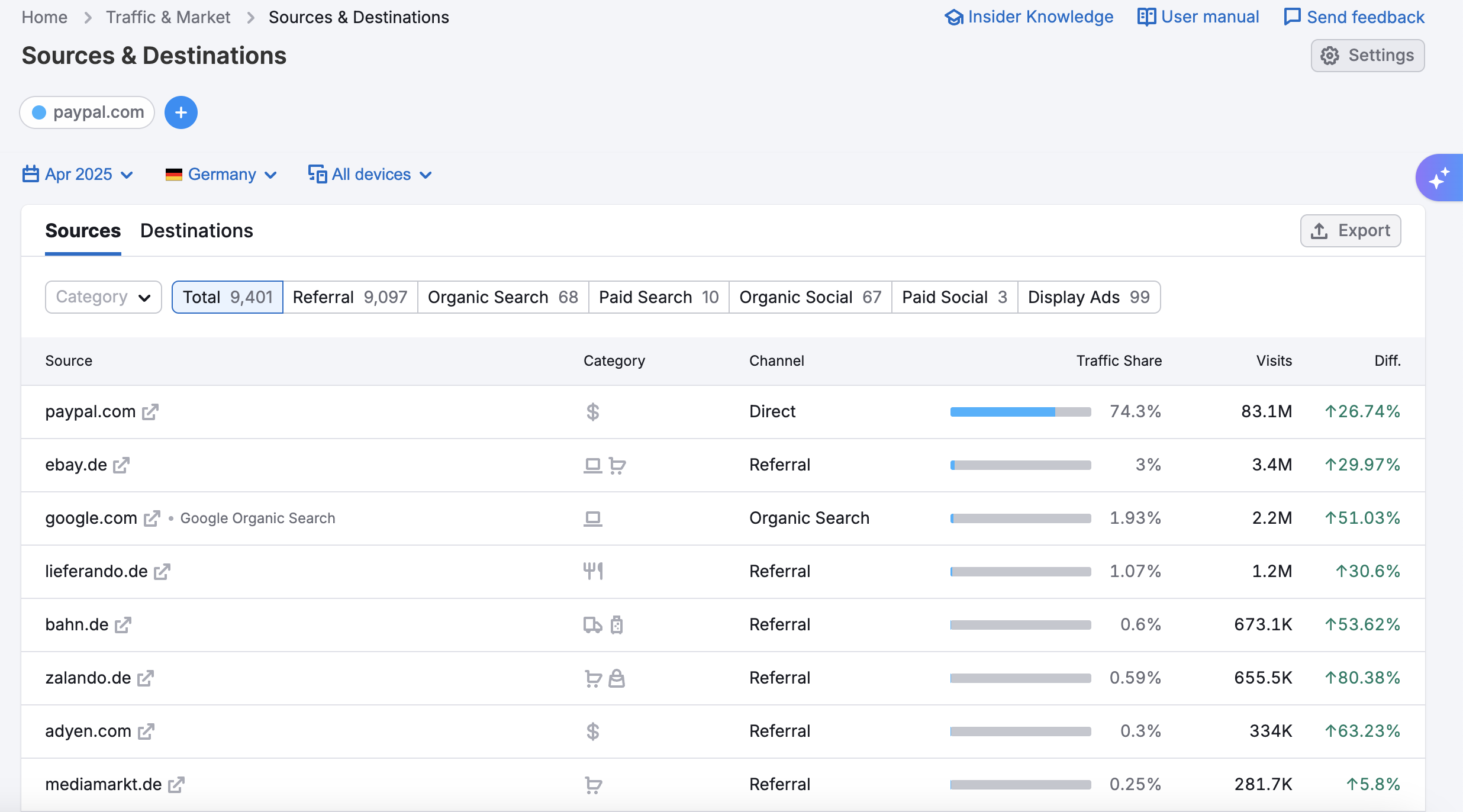

Semrush’s Sources & Destinations dashboard provides user data from potential competitors in prospective markets. The data below reflects Paypal’s activities in Germany.

With this Table we can see where users come from (sources), and where they go after visiting paypal.com (destinations).

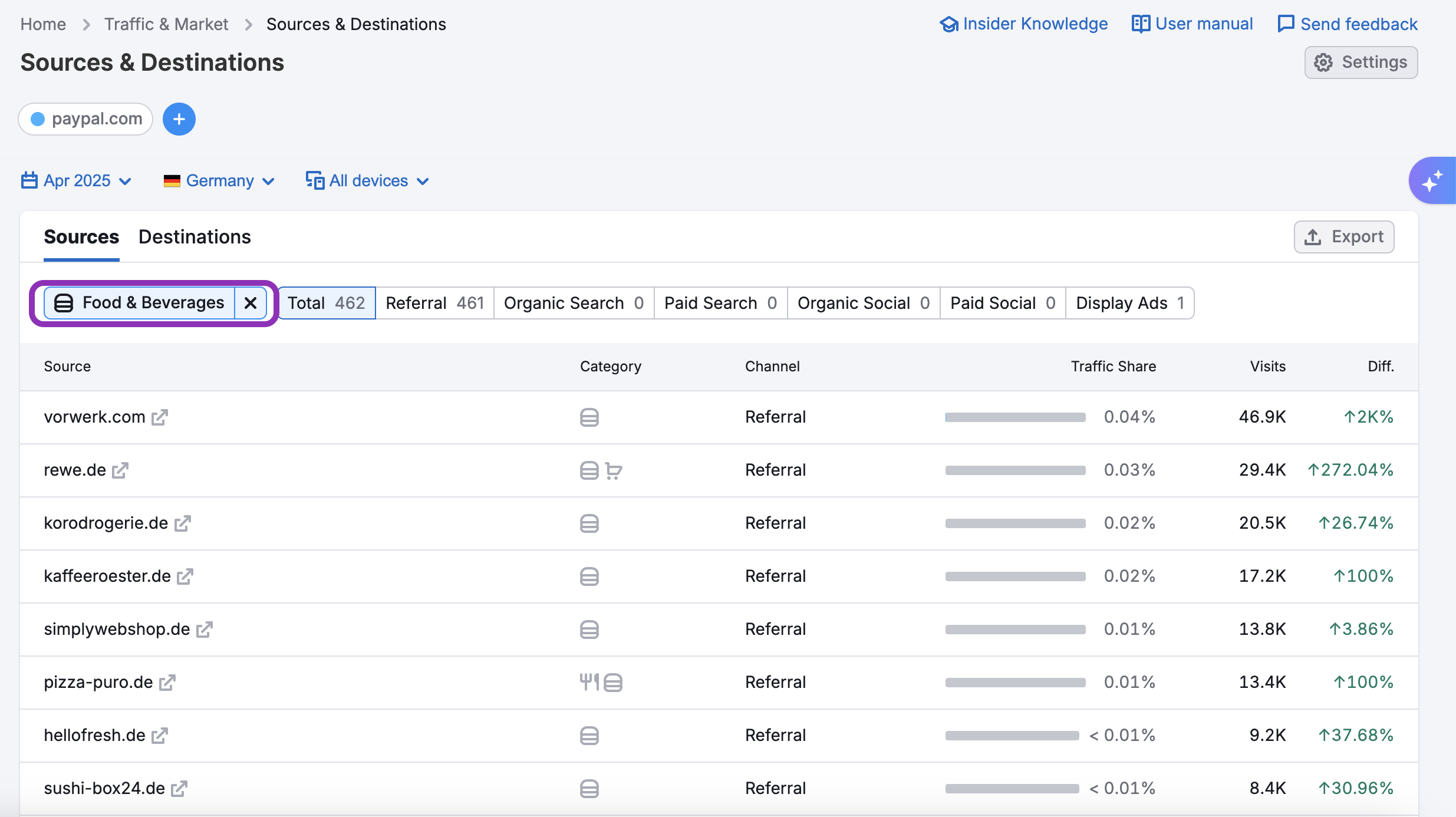

For the German market, this chart offers a few interesting takeaways. For example, some of the top growing sources are food related services. To learn more about this trend, we can filter the chart by “Food & Beverages” category.

In terms of understanding our users, and how we might connect if we were expanding into the German market, this information could add to our strategy.

For example, if we were looking for partners to use our payment processing system, we might look to food related service providers.

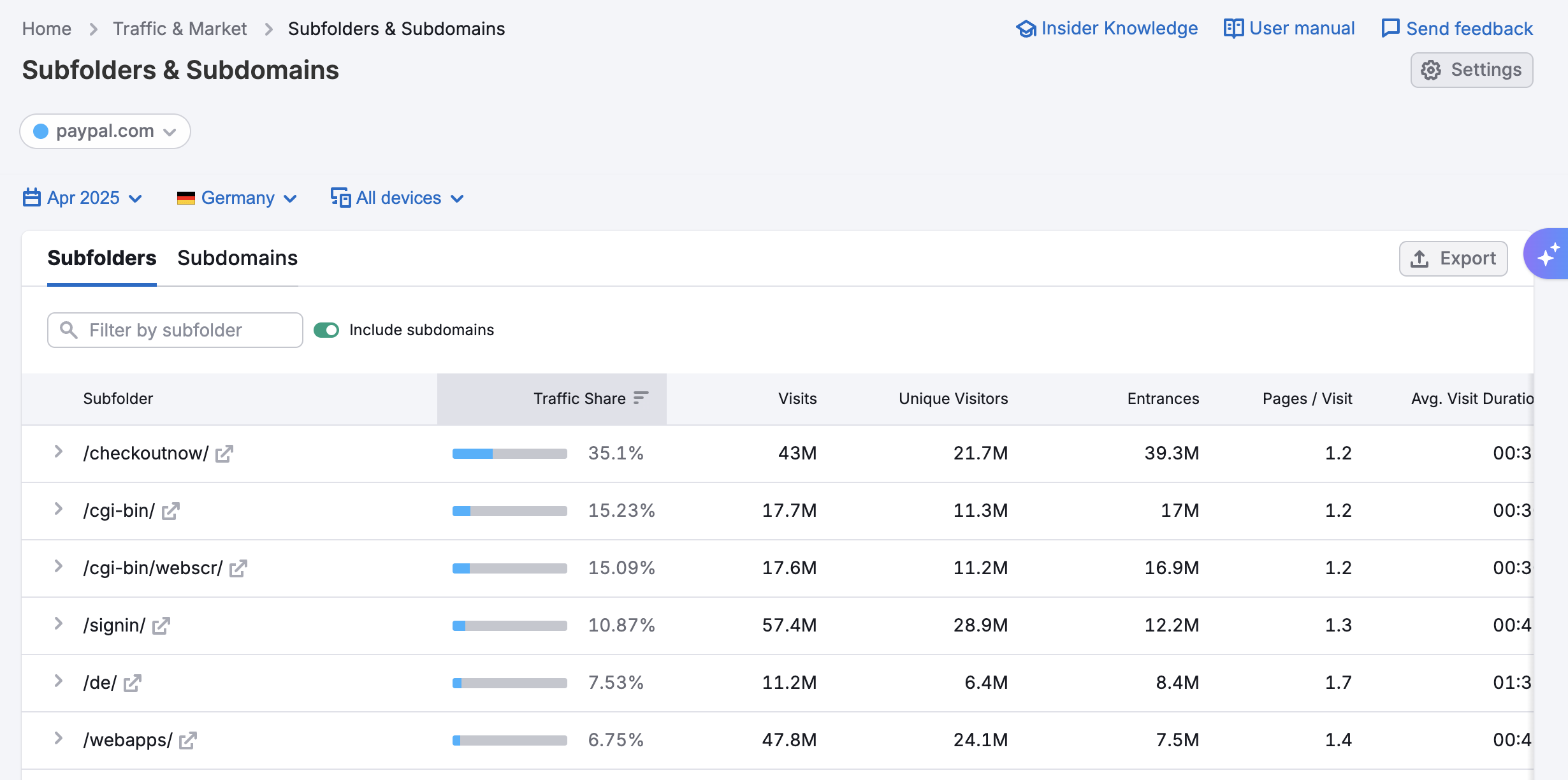

For a better understanding of the products and services that are popular among users in a specific market, begin with the Subfolders & Subdomains dashboard. Here, you can view what subfolders within the competitors website receive the most traffic among users from a specific region.

With the Subfolders table, you can view traffic numbers for specific subfolders from a specific location (in this case Germany) based on the traffic type. The data can reveal what products are most popular and how people reach them.

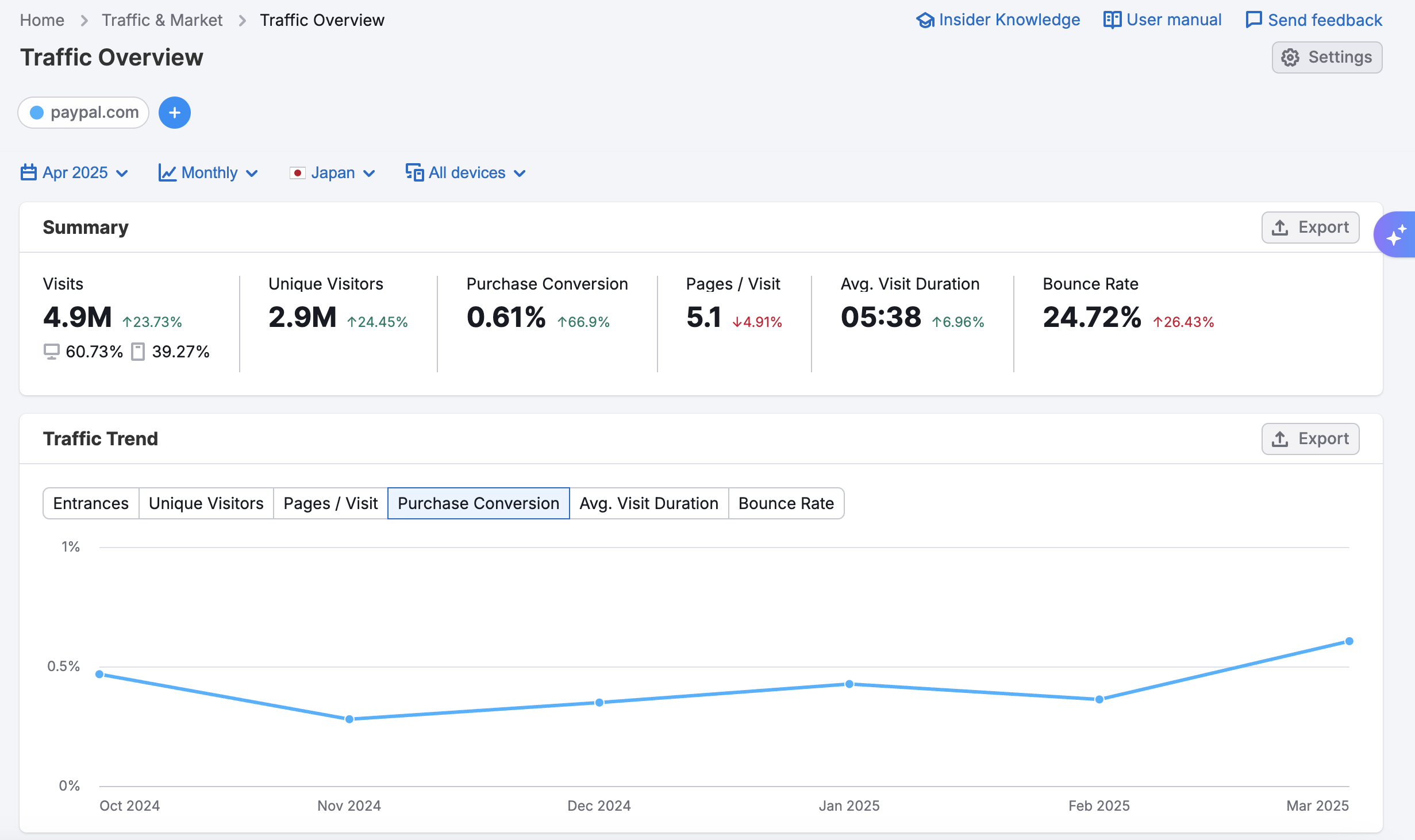

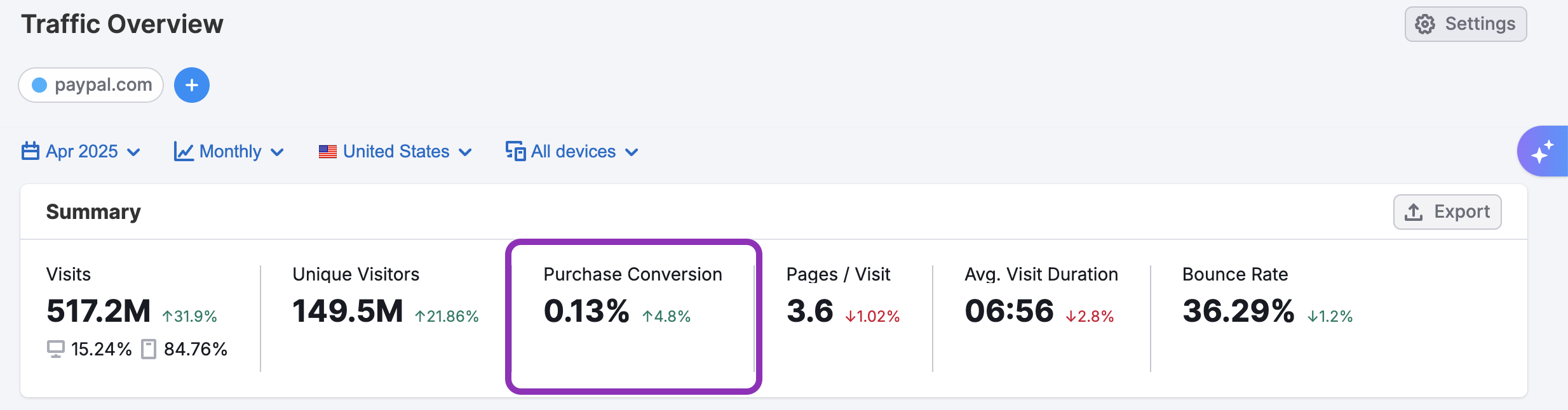

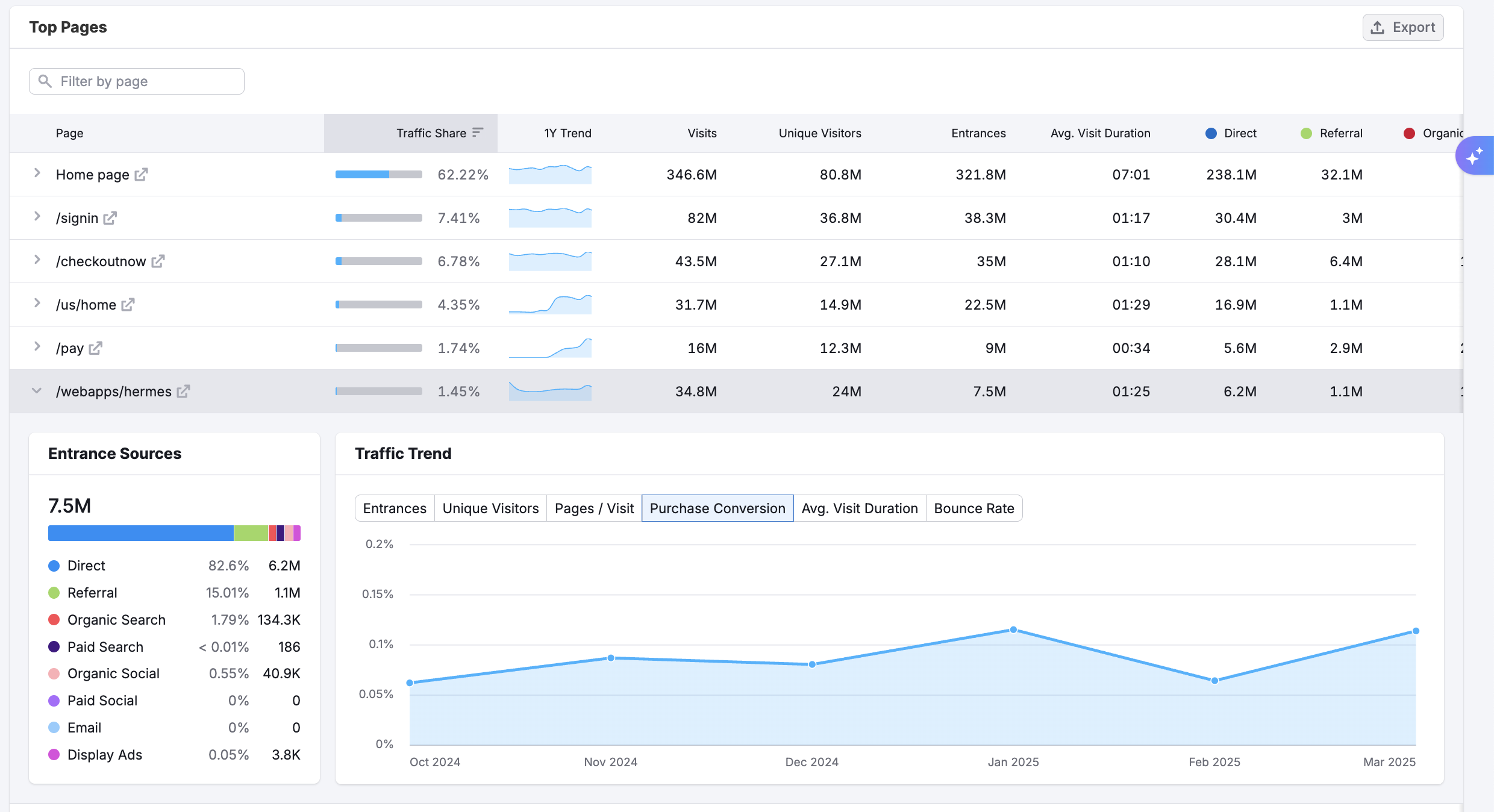

Finally, you can gain insights about customer funnel data returning to the Traffic Analytics dashboard. In the first section, you’ll discover the Purchase Conversion metric. This metric shows you the percentage of site visits that ended with a checkout.

You can take a closer look at the marketing funnel overall with the Top Pages dashboard. Here, you not only discover what pages are most popular, but you can also determine what sources drive traffic to these pages, and develop an understanding of how customers move through the marketing funnel.

Taken as a whole, geographical traffic statistics, location based user journeys, top subfolders and pages, and estimated conversions offer a better understanding of the audience and how to reach them after expansion.

Step 4. Consider language, cultural, and societal barriers to doing business

Beyond audience behavior and funnel data, the culture and society of the target region can impact business. When considering these factors, the first step is to check our own assumptions and keep an open mind toward difference. From this perspective, we can begin the work of understanding.

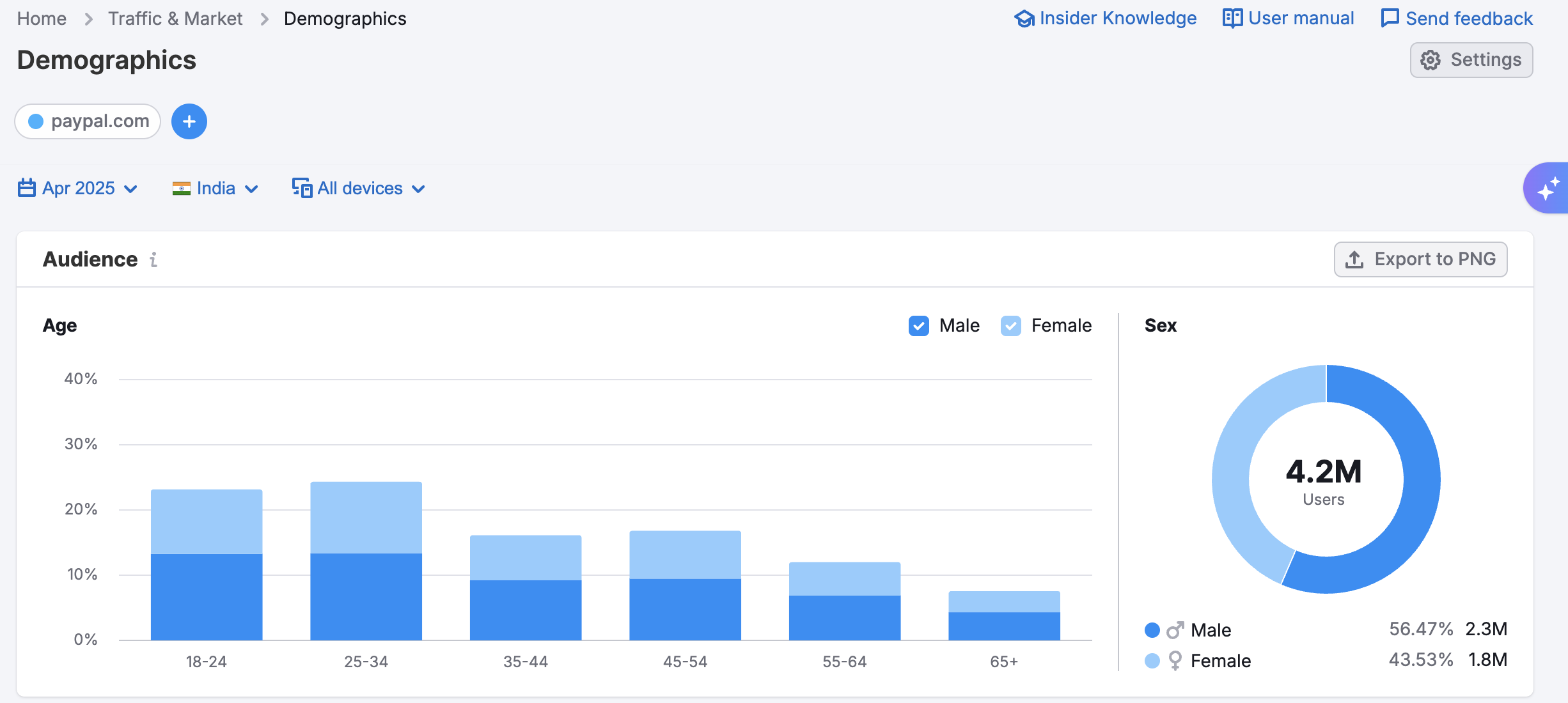

To gather market demographics broadly, use the Demographics dashboard. This data illuminates the age, gender, and geographical locations of audiences.

When expanding beyond the English-speaking world, consider cultural differences, and also consider English proficiency in the target region.

For example, English proficiency is high in Germany, moderate in France, and low in Japan. This means the costs associated with the localization of your product, and all the communication therein, could differ greatly between these countries.

Finally, consider laws and regulations in the prospective geographic area that may impact your business. Some common legal matters include:

- Tax obligations

- Local environmental policies

- Data and intellectual property protection

- Hiring processes and human resources issues

- Realestate

- Marketing and advertising limitations

- Business structure and record keeping

While an understanding of relevant laws and regulations is important for business owners, it always makes sense to get legal help with business expansion into new markets. Violating business laws, even accidentally, can be costly and do damage to a business’s reputation.

Step 5. Benchmark performance against competitors and track trends

No matter the depth and quality of your preliminary market research, tracking market shifts and emerging trends before, during, and after your market expansion is key. Studying your competition and audience on an ongoing basis is the best course of action.

The metrics you choose to track may depend on your specific industry, though Semrush Traffic & Market offers a number of useful options for benchmarking over time. Here are 3 examples:

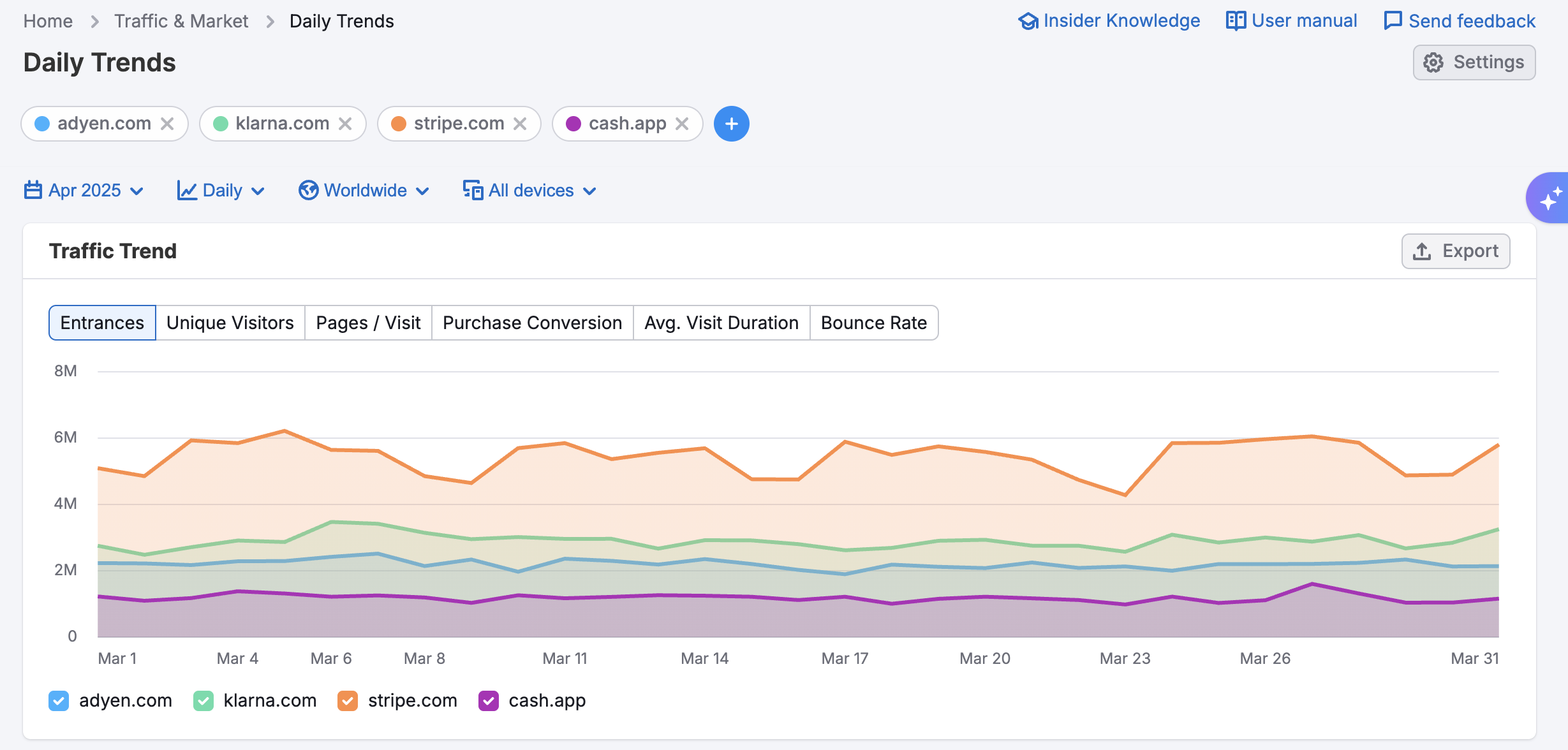

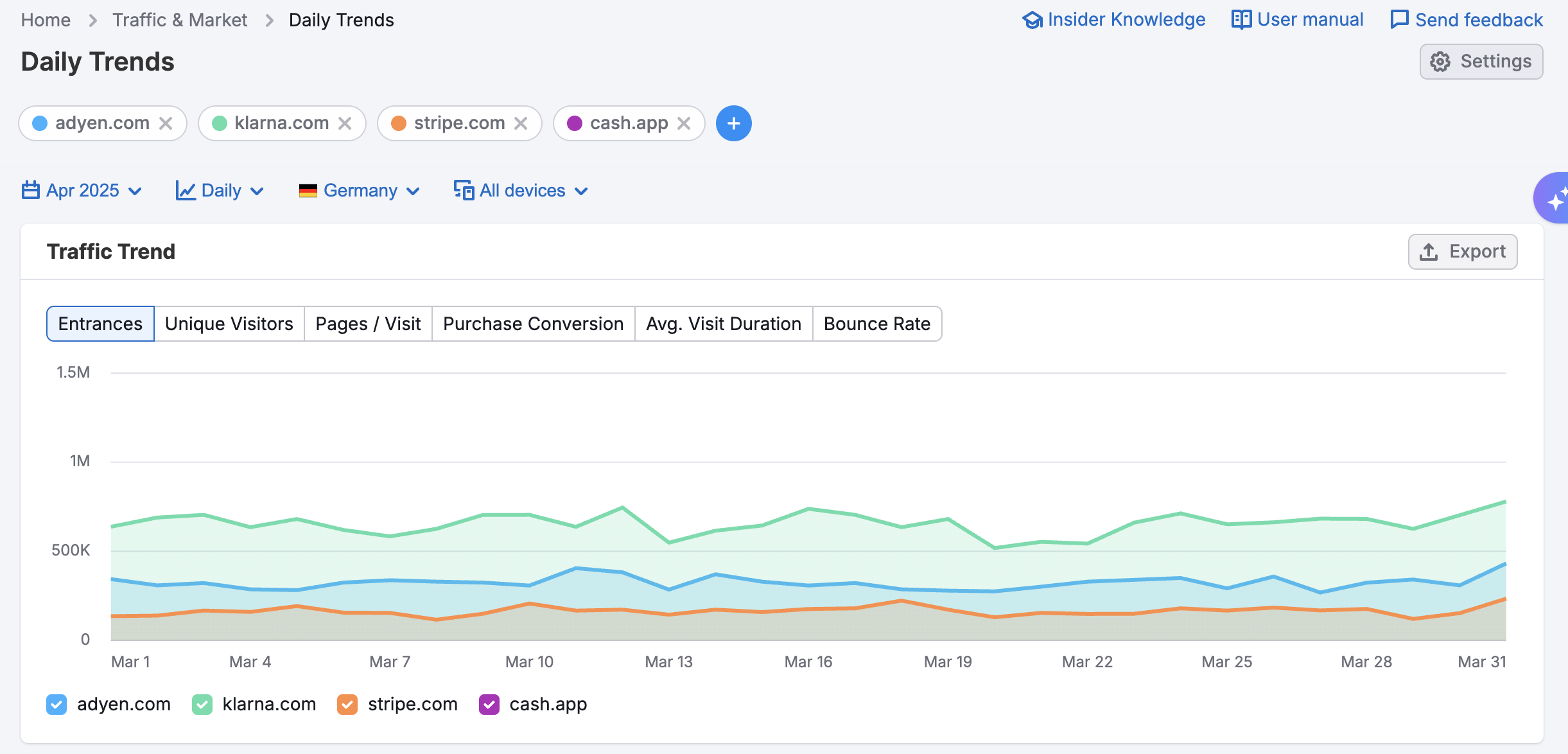

- Use the Daily Trend dashboard to benchmark your website’s performance in your domestic region to make sure your business is keeping pace with the competition at home. While expansion into new markets is exciting, stability at home is crucial.

- Compare your performance against competitors in your new target region. These competitors may be similar to the ones from your domestic market, or they may be specific to your new market. This ensures you’re gaining traction and allows you to identify and implement your competitors’ winning tactics.

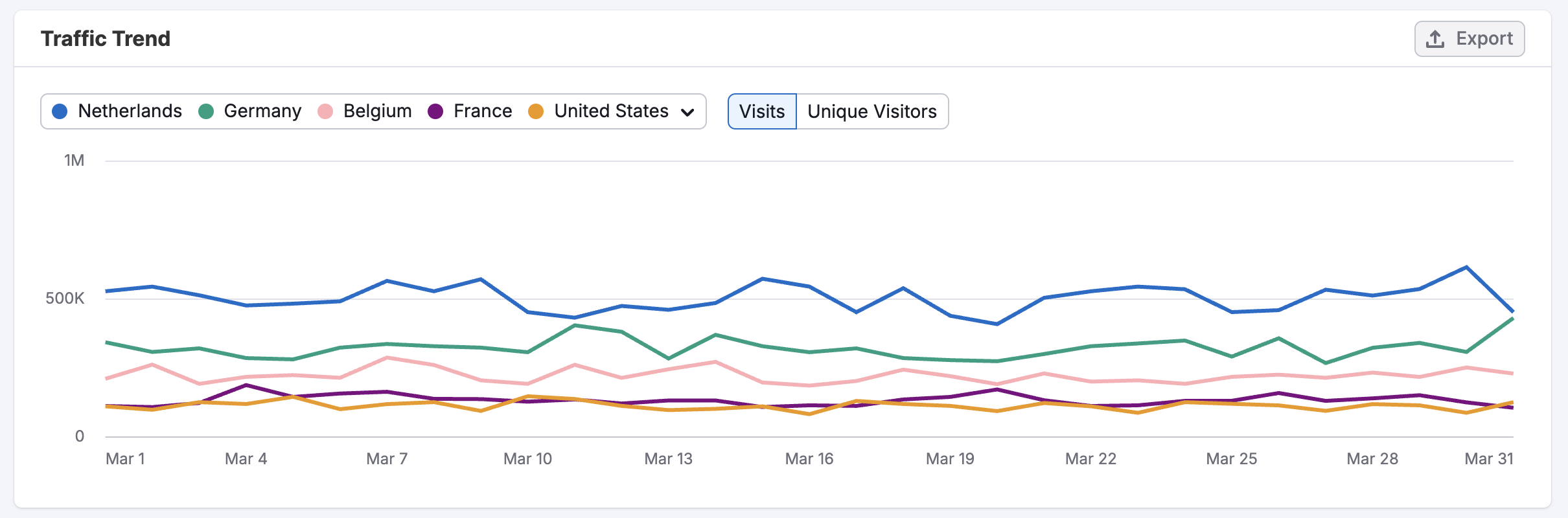

- Compare traffic volumes across regions. Compare the traffic dynamics between countries and analyze the differences in online behaviors in each region. Look for patterns based on the seasons or current events to give you a better indication of how to compete in this market.

Organize Your Market Assessment Data, Generate Market Insights, and Develop a Plan

Expanding into a new market requires plenty of research. When gathering data for a number of locations, organization is key. For help, try our Market Assessment Decision Matrix. You can copy the spreadsheet to your Google Drive by following the link and then filling in the table with all the data you’ve gathered.

This matrix is a convenient way to gather all relevant metrics in one place to identify which country receives the highest score and could have the most potential. Use it to inform your strategy when it comes to identifying your target customers, and benchmarking yourself against your core competitors to ensure your readiness for launch.